The government recently announced a new road tax structure for electric vehicle (EVs) that will be effective from January 1, 2026. The new road tax structure will replace the previous one that was first determined in 2019 and serves to encourage EV adoption with rates that are comparatively cheaper when compared to internal combustion engine (ICE) vehicles.

At present, all EVs registered in Malaysia are not required to pay road tax until the end of 2025 as part of government’s incentives outlined in Budget 2022. If you’re curious how much you’ll be paying after December 31, 2025, you’ve come to the right place. But first, some explanation is needed.

What’s changed with the new EV road tax structure?

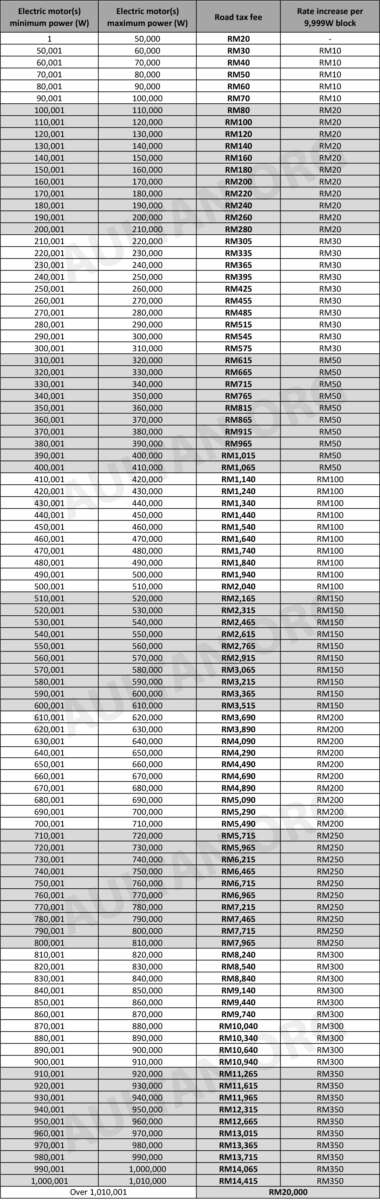

As with the previous EV road tax structure, the new one is still kilowatt (kW)-based and grouped into different motor(s) output power bands. With the older structure, EVs with outputs up to 80,000W (80 kW) are charged a flat rate of either RM20, RM44, RM56 or RM72. Above 80 kW, there are five power bands with differing base and accompanying progressive rates, the latter being a certain amount per 50W (0.05 kW) above the base power output of the band.

The new EV road tax structure also features various power bands, with the first ranging from 1W (0.001 kW) to 100,000W (100 kW). The minimum yearly road tax in this band is RM20, with every 9,999W (9.999 kW) block increment being charged an additional RM10.

Click to enlarge

Other bands will have their own minimum yearly road tax (the base rate) and pricing for each 9.999 kW block increment. Only at the very top is there a flat rate of RM20,000, although this applies to extraordinary EVs with a power output of at least 1,010,001W (10,100.01 kW) or more.

In way, the per block increment is similar to the progressive rate of the older structure, but is cheaper overall because the increment block is larger. For example, an EV with a power output of 100 kW is charged just RM70 with the new structure compared to RM274 with the old one – the latter figure is calculated by adding the base rate (RM224) of the effective band with the progressive rate – (100,000W – 90,000W)/50W x RM0.25).

How much will I be paying for EV road tax from January 1, 2026?

To determine the road tax payable, simply find out your EV’s nominal power output (not the figure with overboost, etc.) and see where it fits within the respective power band range. If the EV makes 155 kW, it would fall between the 150,001W (150.001 kW) and 160,000W (160 kW) range, meaning the road tax is RM180.

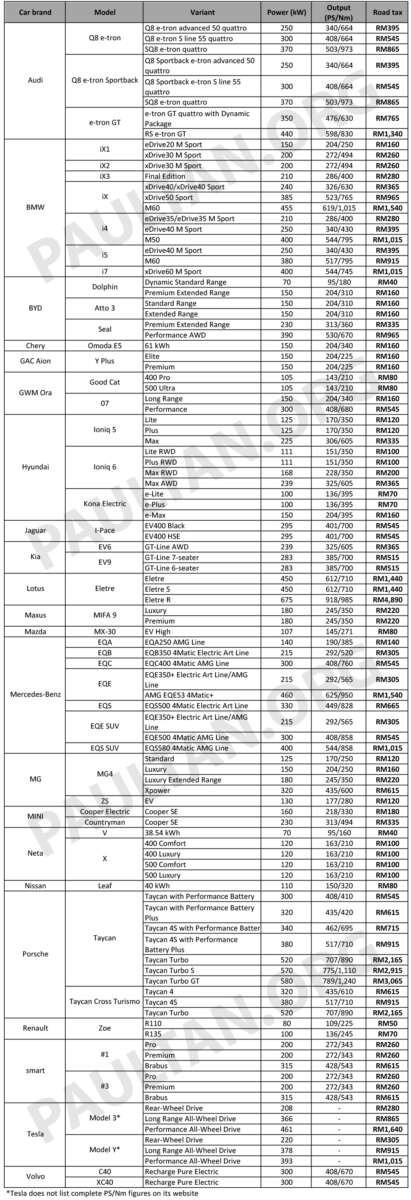

We’ve pulled power outputs of all EVs currently on sale in Malaysia as well as those expected to go on sale here soon to create this handy table for your reference. As you can tell, the amount payable is a lot cheaper than it was before, and we’ll use the BMW i4 eDrive40 M Sport as an example.

Click to enlarge

The i4 eDrive40 M Sport has a power output of 250 kW, which would have a road tax of RM3,724 with the old structure. Over 150,000W (150 kW), the calculation with the previous system would see the base rate (RM1,024) being added with the progressive rate, the latter being the amount of power above 150 kW, which is 100,000W, divided by 50W times RM1.35 to make RM2,700.

With the new structure, the BMW EV’s road tax is reduced to just RM395, which is a massive 89.4% decrease. The lowest powered EVs in our table are the BYD Dolphin Dynamic Standard Range and Neta V with 70 kW, which have a road tax of just RM40. Should you want to do more comparisons, you can do so by using this table as well as the EV road tax calculator based on the older structure currently live on CarBase.my.

So, what do you think of the new EV road tax structure? Does it make EVs more enticing for you and will you be making the switch? Share your thoughts in the comments below.

Looking to sell your car? Sell it with Carro.